Since the Roman Empire era, social leaders have closely monitored the relationship between economic development and social behavior.

Historically, when there is good economic development – providing a good quality of life for citizens – society tends to follow current laws and social norms, formal or informal, that govern people’s attitudes, especially with regard to crime behavior. There is an inversely proportional relationship, that is, the greater the economic development, the lower the crime rates and violations of social rules.

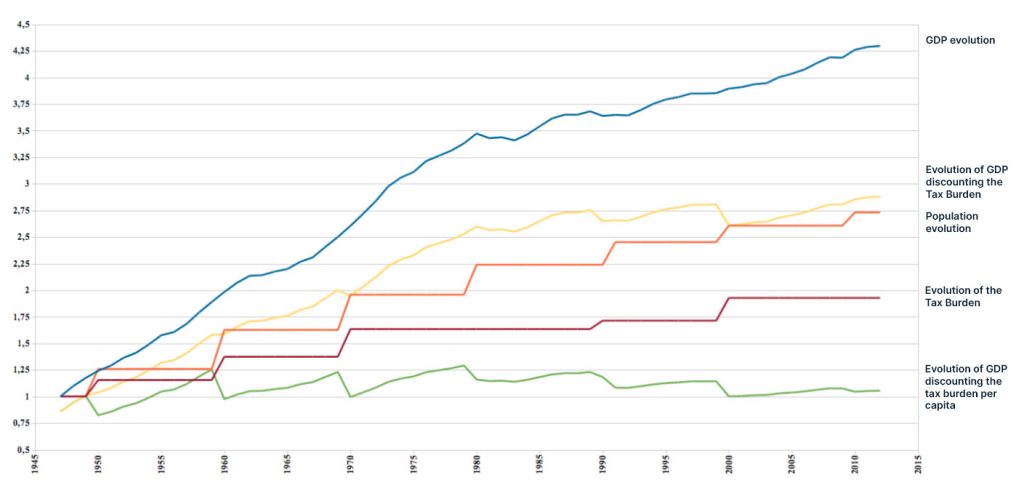

Brazil has shown significant economic development in the last fifteen years, considering the measurement of GDP (Gross Domestic Product). However, two other phenomena in parallel due to be analyzed together: population growth – with an increase of approximately 30% in the period, and the growth of the tax rate in relation to GDP – with an increase close to 21% in the period. The graph below shows these variations over time, according to IBGE (Brazilian Geography and Statistics Institute) data.

As the graph shows, when deducting taxation from the GDP value, the financial value that citizens have access to – the difference is collected in the form of taxes –, and which directly interferes with their quality of life, is stagnant in a narrow range since the beginning of the 1980s. In other words, it is the same financial value that the population had access to 30 years ago.

Another aggravating factor is the fact that the population grew during this period, along with the tax burden, not allowing the amount available to citizens to grow at the same rate. By subtracting the financial amount of taxes from the GDP value and dividing the result by the number of inhabitants in the country, it is observed that the per capita value is falling in relation to the 1980s and 1990s, meaning that the country’s people have the same capital available to a 30% larger population. This would be the situation, for example, of a family made up of three people who have to support a fourth person, without growth contributing this forth person in any way and with no prospects for growth in the family budget.

This means that, although GDP has grown in recent years, the population and tax burden have increased faster, meaning that citizens have access to fewer financial resources than 30 years ago, generating stagnation in access to capital in relation to conditions economics of the past.

It is also observed that higher is the relationship between GDP per capita value, discounting the taxes, enhance better the quality of life of citizens, making the economic and social dynamics conducive to the country’s development. Furthermore, it is observed that when this relationship decreases and approaches the theoretical unitary value (1), economic crises occur with possible political and social instabilities. As the graph shows, historically, this fact promoted significant changes in society and the economy, being detected in the following periods:

- (a) post-war – decades from 1940 to 1950 – fall of the Vargas dictatorship and reinstallation

of democracy; - (b) 1960s – coup d’état by the Military Regime of 1964;

- (c) 1970s – economic crisis and intensification of popular repression and implementation of development plans, “” plan and subsequent political opening of the Republic.

Thus, actually (2013), simultaneously with the indicators that inform economic growth, the media and the press report a growing movement of illegality in public and private acts, growth of corruption and civil crime. A paradoxical set of elements is observed, which historically do not occur at the same time, inducing the illusory idea of economic growth and access to capital by the population, showing that, in parallel with the mathematical technicality used here, the daily reality of the civilian population validates this paradox.

This situation, without any doubt, will require public bodies to carry out an in-depth analysis and planning of social, economic and tax policies so that that economic and political stability in Brazil over the next few years can be real, since similar phenomena were catalysts for major revolutions in the history humanity, such as the French revolution 1789, the US war of independence and the Minas Gerais Revolt in Brazil – in the 18th century –, in addition to the Constitutionalist Revolution of 1932 and the 1964 Coup d’Etat – both in Brazil, in the 20th century.

Edelcio Roncon

Valuations and Market Engineer

This material was prepared by Eng. Edelcio Teixeira Roncon, who certifies that the opinions contained therein exclusively reflect his personal opinions on the assets and their securities and/or financial securities and were prepared independently and autonomously.

The information contained in this analysis material is considered true on the date of issuance and comes from public sources considered reliable by the author. The author does not guarantee the accuracy, completeness or security of the information.

The author does not undertake that readers/investors will make a profit, nor will he have any responsibility in case of losses, direct or indirect, as a consequence of the use of this document.

The information contained in this material may not be appropriate for the recipient’s investment profile. Investments involve risks and investors must exercise caution when making their personal decisions and should not substitute their own judgments for those set out in this document at any time or under any circumstances.

The opinions, estimates and projections contained in the material constitute the author’s current analysis on the date it was issued and are subject to change, without prior notice, and may be different or contrary to the opinions expressed by other areas of activity of the author or other analysts related and/or independent to it, as a consequence of the adoption of different criteria and methodologies.

This material may not be reproduced or redistributed to anyone, in whole or in part, for any purpose, without the prior written authorization of the author, and the author is not responsible for actions contrary to the provisions herein by third parties.